Bitcoin Block Reward Halving

Countdown

Total bitcoin left to mine

1,011,886.291Bitcoin price

$67,166.00Blocks until halving

113,619- Total amount of bitcoin to be mined: 21,000,000

- Bitcoin in circulation: 19,988,113.709

- Total bitcoin left to mine: 1,011,886.291

- Bitcoin price: $67,166.00

- Bitcoin market capitalization: $1,342,521,645,360.32

- Bitcoins generated per day: 543.75

- Bitcoins generated per day after halving: 271.875

- Amount of blocks before halving: 1,050,000

- Current block height: 936,381

- Blocks until halving: 113,619

- Block generation time (minutes): 8.21

- Blocks generated per day: 174

- Current Bitcoin block reward: 3.125 BTC

- Block reward after halving: 1.5625 BTC

Bitcoin halving explained — What it is and how it affects the market and its participants.

The term 'Bitcoin Halving' seems to have seeped into the consciousness of crypto enthusiasts across the globe over the last few years. However, despite this, many people aren't really aware of what the term means and how it has a direct impact on the price of Bitcoin. As part of this explanatory piece, we will seek to explain the concept of the Bitcoin Halving in detail and many of the key aspects associated with it. So without any further ado, let's jump straight into the heart of the matter.

So what exactly does a halving entail?

In its most basic sense, Bitcoin halving is an event that takes place every four years, cutting the digital asset's block reward ratio by exactly fifty percent. Following the halving, the total supply of new BTC coming into existence goes down, which in turn helps drive the currency's value in an upward direction.

Technically speaking, Bitcoin's above-stated halving event is directly related to how the digital currency is mined. Mining is a process by which new transactions are added to BTC's native blockchain. Using the process, it is possible for investors to accrue BTC without having to purchase it. Basically, whenever miners deploy their computing power to validate transactions, they are provided with a fixed amount of the token in lieu of their efforts.

To elaborate, in every instance where a miner is able to solve a mathematical problem associated with the Bitcoin blockchain, they are provided with the token — referred to as a “block reward.” As things stand, a new block is added to the blockchain every 600 seconds, the reward for which is 6.25 BTC.

The halving's impact on miners

As mentioned previously, following a halving event, the total number of Bitcoin awarded to miners gets slashed by 50%, drastically reducing the currency's supply ratio while increasing its market demand (ala supply and demand).

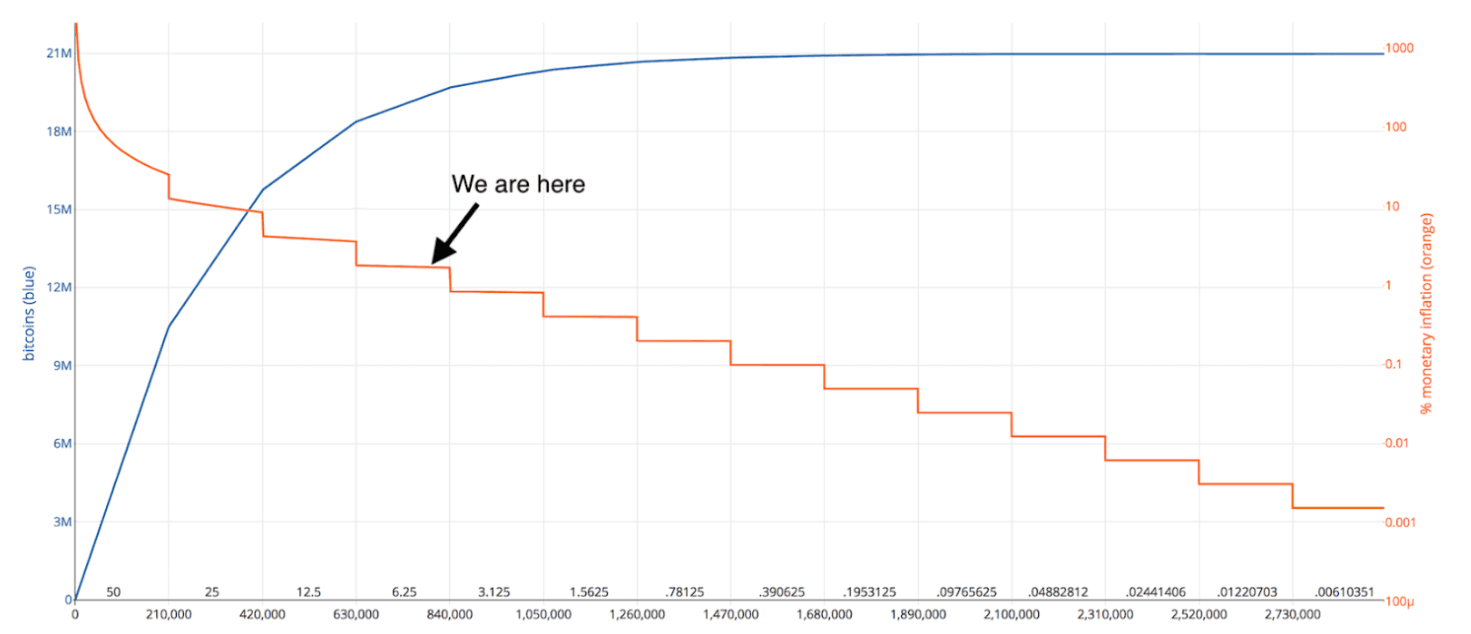

The pseudonymous creator of the BTC network, Satoshi Nakamoto, defined in his whitepaper that, in total, only 21 million Bitcoin can/will ever come into existence. It is estimated that the last token will be mined sometime around 2144, even though over 90% of the currency's supply has already entered the market. Currently, around 900 BTC are mined on a day-to-day basis, with this number set to dip to 450 after the next halving cycle.

After every four years, this number dips, eventually taking Bitcoin's reward ratio to a fractional limit. To put things into perspective, within the next 10 halving cycles, the asset's reward output will reduce to less than 1 coin per day, making its market availability extremely scarce.

Bitcoin's supply ratio over time versus its inflation rate

The two different BTC halving countdowns explained

As many Bitcoin enthusiasts may be aware of, there currently exist two unique means of estimating the time for the next halving. These include:

Top Countdown

The top countdown drives its data efficacy from on-chain info extracted from the Bitcoin blockchain itself. Since the average block time is not always 600 seconds (10 mins), the time of the halving may change over time. That said, the difficulty adjustment of the Bitcoin blockchain is maintained in such a way that its block time stays close to the 10 min mark.

Bottom Countdown

As opposed to the top countdown function, the lower Bitcoin halving metric is simpler in its approach, basing its calculations on an average block time of 10 minutes, thus providing enthusiasts with a good approximation for the halving.

The nitty-gritty of the halving

Whenever Bitcoin's hash rate goes up or down in a dramatic manner, it can have a major effect on the currency's difficulty adjustment. This means that it could potentially lead to the halving occurring sooner or later than expected. Bitcoin's hash rate refers to the amount of processing and computing power being given to the network through mining.

Lastly, as mentioned previously, a halving takes place every 48 months (i.e. 4 years); however, a more accurate measurement would be to say that it occurs every 210,000 blocks.

When is the next halving supposed to take place?

Upon its launch in 2009, the Bitcoin network possessed a block reward ratio of 50 tokens. This number peaked at 25 on November 28th, 2012, dropping to 12.5 in 2016 and then 6.25 in 2020.

It is estimated that in 2024, the digital asset will witness its 4th halving, following which Bitcoin's reward ratio will come down to 3.125. This process will continue till there are 0 BTC that can come into circulation. On a technical note, Bitcoin's current inflation rate stands at 3.68%, which is set to come down to 1.80% in 2024, which means that once the currency dips below the inflation target of 2%, that has been designated by many central banks across the globe, it will become more lucrative as a store of value (SOV).

Not only that, it bears mentioning that the inflation rate of gold — one of the most popular precious metals in the world — currently stands at 1.6%, making Bitcoin increasingly more attractive to long-term investors as and when its inflation levels dip further.

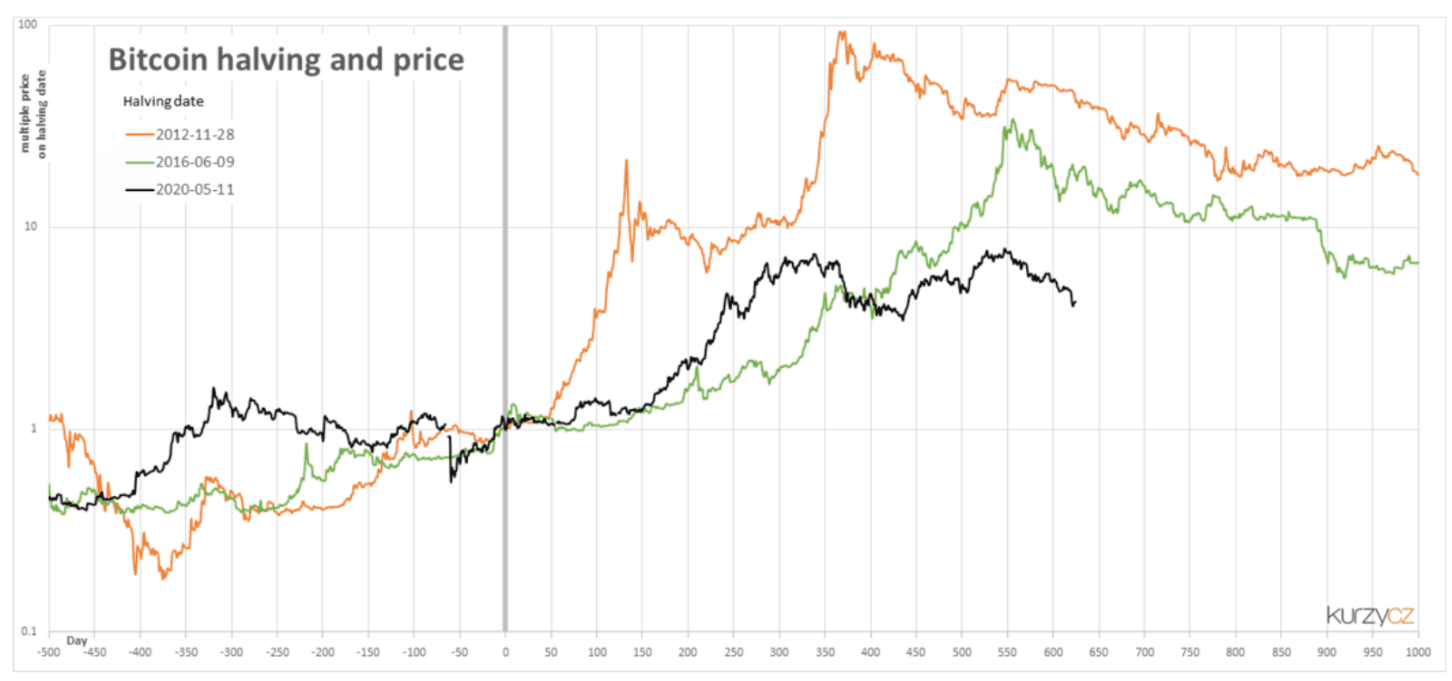

Lastly, from a historical perspective, following every halving, Bitcoin has experienced a visible spike in its value. And while this trend is not set in stone, there seems to be a high probability that the same will happen again as well.

Bitcoin's value post its previous halving cycles.

The impact of halvings on investor gains and the market in general

Many crypto investors across the globe tend to take advantage of halvings by accumulating the digital currency before the event. While some investors sell their holdings (or at least a part of them) after the halving (in lieu of short-term gains), most investors buy and hold Bitcoin because of its long-term market potential. This is primarily because, following many of the past halvings, Bitcoin's value has increased by more than 500%. That said, past gains do not ensure future returns.

In terms of how Bitcoin affects the crypto industry as a whole, one can see that the asset currently possesses a market dominance ratio of around 40%, suggesting that any movements in its price will have a sure shot impact on the sector as a whole (especially the altcoins in the top 50).

Another trend worth noting is that during bull runs, the performance of many altcoins pales in comparison to Bitcoin since investors tend to sell these peripheral coins and move their funds into BTC. Conversely, altcoins usually perform better when BTC is confined within a particular price range or consolidating around an area of major support or resistance.